Interest Rate Cut Speculation Heats Up!

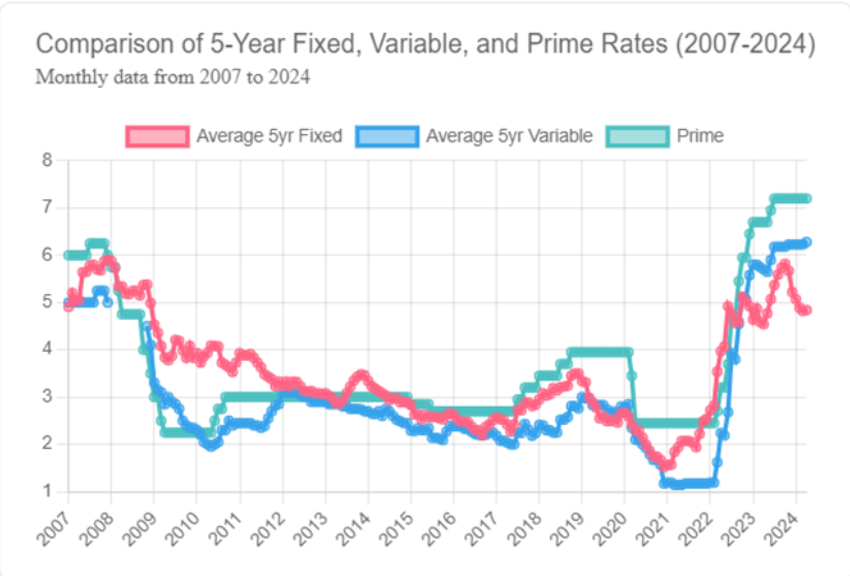

Rate cut speculation is heating up! We wanted to touch on a few things in regard to the big “interest rate conversation”. Yes, the Bank of Canada will very likely start cutting the Bank of Canada rate this summer (perhaps as soon as next month). This will immediately impact Variable Rate mortgage holders. Currently, the prime lending rate is 7.20% meaning a 0.25% rate cut by the BOC should mean that banks will follow suit and cut prime to 6.95%. The US jobs numbers on Friday have improved the odds of a predicted BOC bank cut. This week rate watchers will be focused on the Canadian numbers (due out on Friday May 10th). Economists that we follow speculate that the current fixed rates are already pricing in the BOC’s first two cuts. This means that a cut in June or July may not impact fixed rates at all. The cut will narrow the spread between fixed and variable. If history is a predictor, this chart we created illustrates this where the green line will simply drop, narrowing the gap between prime, fixed and variable.

Here's what we know right now:

“When the probability of next-meeting rate cuts exceeds 60%, it's safe to start feeling confident about near-term easing. As we speak, we're at 74% for the BoC's June 5 meeting. So, if not June, it may be Christmas in July for Canadian borrowers.” Robert McLister, Mortgage Logic News May 3, 2034

For mortgage holders up for renewal and buyers entering the market, the big question right now is fixed or variable? Short term or lock in for 3 years? Or set it and forget it at 5 years?

We now have one lender offering a short term promo of Prime minus 1.01% for a variable rate. Is this the right move to ride the BOC cuts down? Fixed rates for shorter terms are still over 6% and the three-year and five-year terms are in the mid to low 5’s.

What should borrowers be choosing? This is a very personal decision and will depend on personal goals, budgets, risk tolerance and time horizon for holding the mortgage.

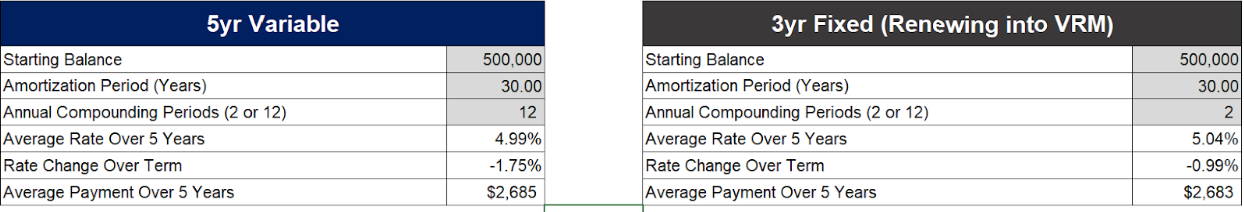

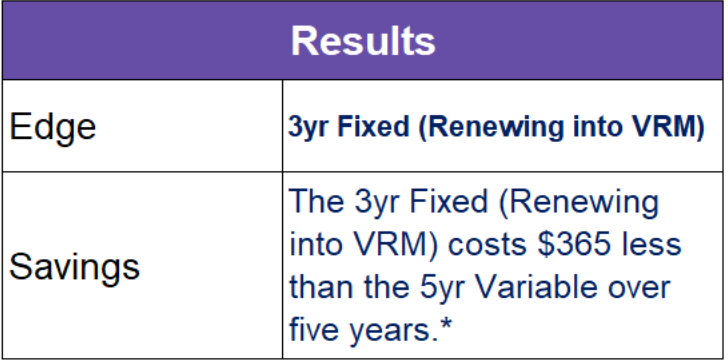

We have some fancy tools that can help with the decision make process. Here’s one example where we compared a $500,000 Mortgage taking a 3-year fixed at 5.44% (renewing into a Variable in 3 years) versus the 5-year variable at 6.29% and modelling 0.25% rate cuts as follows: in 2 cuts in 2024, 2 cuts in 2025, 1 cut in 2026 and 1 cut in 2027.

In this case, the 3-year fixed rate “wins” but the savings is minimal. There are many factors to consider here including that taking the higher variable rate now would mean that this borrower qualifies for a lower mortgage amount (stress testing at 8.19% instead of 7.44%). Of course, the other BIG factor is that we are guessing that prime will drop and at the pace we have modelled out.

All this is to say that the rate conversation is a complicated. We love helping borrowers make informed decisions about their mortgage choice whether they are buying or they are renewing. If you have questions or want us to run some numbers, please reach out.

Share